More than half of all Australians live pay cheque to pay cheque and I was one of them for many years.

Welcome to Your Money Flow. My name is Habib Esmaty and before I joined the financial services sector 7 years ago, I worked in manufacturing and logistics industries for over 10 years. Throughout my working life I struggled with money even though I was earning a living wage for many years.

My personal Money journey!

- My relationship in the past with money was that of INDIFFERENCE

- As-long-as I was able to cover the necessities the rest would be spend well before the next pay

- Once I came across Peter Pyhrr’s zero-based budgeting idea my finances improved significantly

- I built a spread sheet

- I put a banking structure in place

- As they say the rest is history and here, I am offering you an opportunity to do the same and get the same results.

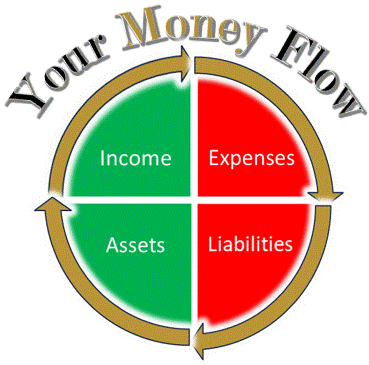

Once you understand the concept of your money flow, you too will break the cycle of living pay cheque to pay cheque.

Why this course?

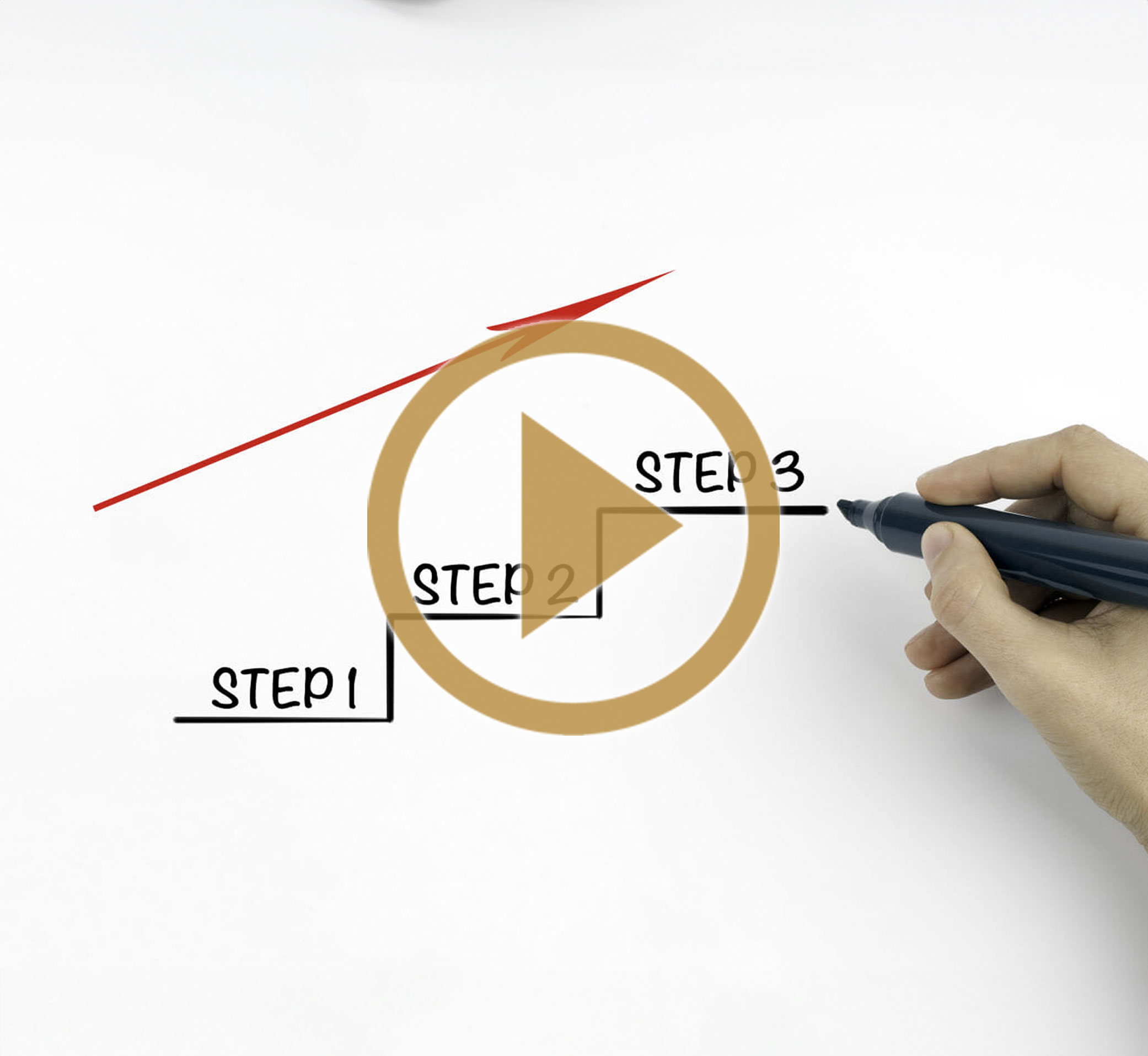

I have put together this short course in a form of 5 video modules to share with you, what I have learned from Master level education at university, but more importantly from lived experience.

I have taken a step-by-step approach to put the following 5 modules together to cover everything from the purpose of money (why it actually exists) to your personal relationship with money (your past interaction with money from childhood to now) to your money structure (how you spend money at the moment) to what assets and liabilities are (what you own and what you owe).

How is this course structured?

Our Modules

Module 1:

What is money?

In this module, we will examine commonly held beliefs and misconceptions about money & take a closer look at the actual function of money.

Module 2:

Our relationship to money

In this module, we will look at how far your money flows during each pay cycle & spend time understanding how to nurture your relationship with money.

Module 3:

Money structure

In this module, we show you how having a plan for your money will take the stress out of having to deal with money issues that will inevitably arise in your life.

Module 4:

Understanding debt

Not all debts are created equally! In this module, we discuss the role of debt in building wealth & take a close look at what constitutes a bad/personal debt.

Module 5:

Understanding assets

In this final module, we look at what constitutes an asset. Not all assets are created equally so we will explore those different asset types.