As we bid farewell to the old and welcome the new, the dawn of a new year offers us a prime opportunity to reflect on the past and set our sights on the future. Amidst the multitude of resolutions that often make their way onto our lists, one area deserving special attention is our financial well-being. Crafting New Year’s resolutions about money isn’t just about numbers on a spreadsheet; it’s a commitment to building a secure and prosperous future.

As we bid farewell to the old and welcome the new, the dawn of a new year offers us a prime opportunity to reflect on the past and set our sights on the future. Amidst the multitude of resolutions that often make their way onto our lists, one area deserving special attention is our financial well-being. Crafting New Year’s resolutions about money isn’t just about numbers on a spreadsheet; it’s a commitment to building a secure and prosperous future.

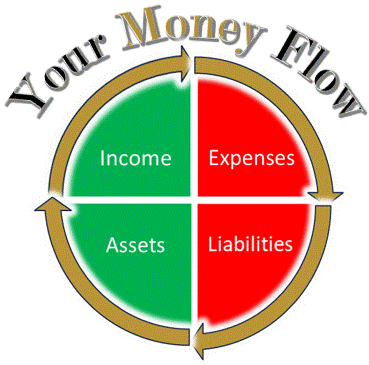

1. Assessing the Financial Landscape: Before setting any financial resolutions, take a moment to assess your current financial standing. Analyse your income, expenses, debts, and savings. Understanding where you stand will provide a solid foundation for creating realistic and achievable goals.

2. Building an Emergency Fund: One of the first resolutions on your list should be the establishment of an emergency fund. Life is unpredictable, and having a financial safety net can help you weather unexpected storms without derailing your long-term plans. Aim to save at least three to six months’ worth of living expenses in a readily accessible account.

3. Creating a Budget: Budgeting is the cornerstone of financial success. Resolve to create a realistic and detailed budget that encompasses all your income sources and outlines your monthly expenses. This will help you identify areas where you can cut back and allocate more funds towards savings or debt repayment. I suggest using the one available for free at www.moneysmart.gov.au.

4. Tackling Debt Strategically: Debt can be a significant obstacle to financial freedom. Set specific goals for paying down high-interest debts, such as credit card balances or outstanding loans. Consider employing the snowball or avalanche method, focusing on one debt at a time, to make your progress more tangible.

5. Investing in Knowledge: Financial literacy is an invaluable asset. Commit to expanding your financial knowledge in the coming year. Attend workshops, read books, and explore online resources to better understand topics like investing, retirement planning, and tax strategies. The more you know, the more empowered you’ll be to make informed decisions about your money. My recommendation ‘the richest man in Babylon’ by Samuel Clason

6. Setting Savings Milestones: Whether you’re saving for deposit for a home, a dream vacation, or your children’s education, set specific savings goals. Break down these goals into manageable milestones and track your progress regularly. Celebrate small victories along the way to stay motivated.

7. Planning for Retirement: It’s never too early to start planning for retirement. If you haven’t already, make a resolution to contribute regularly to superannuation. Explore ways you can boost your super balance and consider consulting with a financial advisor to ensure your retirement strategy aligns with your long-term goals.

8. Embracing Smart Spending Habits: Evaluate your spending habits and identify areas where you can make smarter choices. Differentiate between wants and needs, and practice mindful spending. Consider adopting the 24-hour rule for non-essential purchases – wait a day before making a buying decision to determine if it’s a necessity or an impulse.

9. Seeking Professional Guidance: If navigating the intricacies of personal finance feels overwhelming, consider seeking guidance from a financial advisor. A professional can help you develop a comprehensive financial plan, provide insights into investment strategies, and offer personalized advice tailored to your unique circumstances.

10. Cultivating a Long-Term Mindset: Finally, as you embark on your financial journey in the new year, cultivate a long-term mindset. Understand that financial success is a marathon, not a sprint. Be patient, stay disciplined, and stay committed to your resolutions, knowing that the positive impact on your financial well-being will extend far beyond the year ahead.

In conclusion, making New Year’s resolutions about money isn’t just about fiscal responsibility; it’s a commitment to building a life of financial freedom and security. By setting clear and achievable financial goals, embracing smart money habits, and continually educating yourself, you pave the way for a prosperous future in the years to come.

Cheers to a financially empowered new year!