In the labyrinth of economic indicators, the Consumer Price Index (CPI) stands tall as a beacon, guiding us through the tumultuous waters of changing prices. It’s not just a collection of letters; it’s a numerical superhero that helps us understand the ebb and flow of our everyday expenses. So, let’s embark on a journey to demystify the CPI and discover how it serves as our economic compass in a sea of prices.

In the labyrinth of economic indicators, the Consumer Price Index (CPI) stands tall as a beacon, guiding us through the tumultuous waters of changing prices. It’s not just a collection of letters; it’s a numerical superhero that helps us understand the ebb and flow of our everyday expenses. So, let’s embark on a journey to demystify the CPI and discover how it serves as our economic compass in a sea of prices.

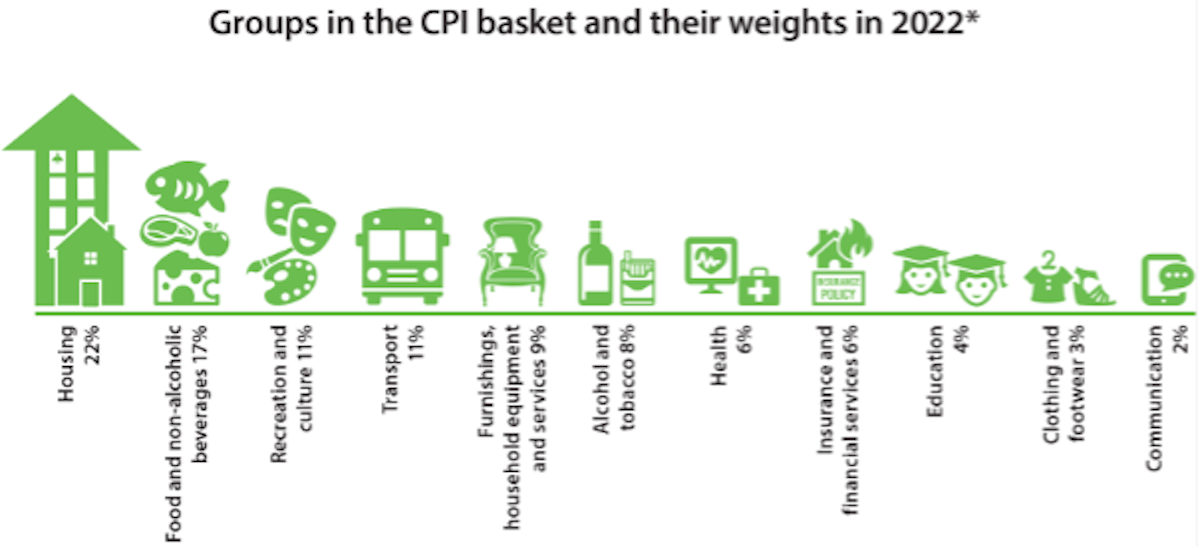

At its essence, the Consumer Price Index is a statistical measure that tracks the average change in prices paid by consumers for a basket of goods and services over time. Think of it as a snapshot of the cost of living, capturing the rise and fall of prices that impact our daily lives. This basket includes everything from a loaf of bread to the latest tech gadget, reflecting the diverse array of items we purchase regularly.

Now, why does the CPI matter? Well, it’s the compass that helps us navigate the complex terrain of inflation. Inflation, the subtle thief of our purchasing power, is revealed through the CPI’s lens. When the index rises, it signals that the prices of goods and services are on the upswing, quietly eroding the real value of our money.

Let’s break it down with a simple example. Imagine you have a basket of goods that cost $100 in the base year. If, over time, the CPI rises to 110, it means that the same basket of goods that used to cost $100 now costs $110. This increase indicates a 10% rise in prices since the base year. It’s like a price-tag time machine, allowing us to compare the cost of living today with that of the past.

The CPI is not a one-size-fits-all measure; it adapts to the evolving consumption patterns of society. As our preferences change and technology advances, the basket of goods and services in the CPI is periodically updated to reflect the contemporary consumer experience. So, whether it’s the latest smartphone or a plant-based meat substitute, the CPI stays current, mirroring the items that fill our shopping carts.

Now, let’s sprinkle in a bit of humour to lighten the analytical mood. The CPI is like the Sherlock Holmes of economics, investigating the mysteries of rising prices and revealing the hidden culprits behind the inflationary scenes. It’s not about catching criminals but rather understanding the economic forces that shape our financial landscape.

Beyond its role in deciphering inflation, the CPI also serves as a vital tool for policymakers. Governments and central banks use this index to make informed decisions about interest rates, wages, and social security benefits. It’s like the economic weather forecast – helping policymakers anticipate and navigate potential storms in the economy.

However, like any superhero, the CPI has its limitations. It doesn’t capture the full spectrum of individual spending habits, and certain items may be overrepresented or underrepresented in the basket. Critics argue that it may not accurately reflect the inflation experienced by specific demographics. Nonetheless, it remains a crucial compass, providing a broad overview of the economic landscape.

In conclusion, the Consumer Price Index is not just a set of numbers; it’s our economic compass in a sea of prices. It allows us to decode the mysteries of inflation, understand the changing cost of living, and provides policymakers with the insights needed to steer the ship of the economy. So, the next time you hear about the CPI, remember that it’s more than an acronym – it’s the Sherlock Holmes helping us solve the case of the rising prices.