Personal assets and liabilities are two fundamental concepts in personal finance. They are used to describe an individual’s financial position. In this blog post, we will discuss the difference between personal assets and liabilities and provide examples of each.

Personal assets and liabilities are two fundamental concepts in personal finance. They are used to describe an individual’s financial position. In this blog post, we will discuss the difference between personal assets and liabilities and provide examples of each.

What are personal assets?

Personal assets are things that an individual owns that have value and positively impact their net worth. Personal assets can be tangible or intangible. Tangible assets are physical assets that can be touched, such as a car, a house, or jewellery. Intangible assets are non-physical assets that cannot be touched, such as stocks, bonds, or intellectual property.

Personal assets can be further classified into current assets and non-current assets. Current assets are assets that can be converted into cash within one year. Examples of current assets include cash, savings, and investments. Non-current assets are assets that cannot be converted into cash within one year. Examples of non-current assets include property, real estate, and long-term investments.

What are personal liabilities?

Personal liabilities are debts that an individual owes or has borrowed that have a negative impact on their net worth. Personal liabilities can be classified into current liabilities and non-current liabilities. Current liabilities are liabilities that are due within one year. Examples of current liabilities include credit card debt, personal loans, and taxes payable. Non-current liabilities are liabilities that are due after one year. Examples of non-current liabilities include mortgages, student loans, and car loans.

Difference between personal assets and liabilities

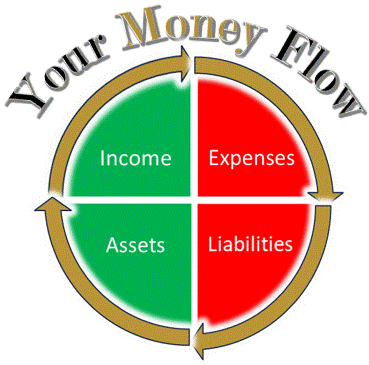

The main difference between personal assets and liabilities is that personal assets are things that an individual owns that have value and positively impact their net worth, while personal liabilities are debts that an individual owes or has borrowed that have a negative impact on their net worth. Personal assets are resources that can be used to generate revenue, while personal liabilities are obligations that must be fulfilled.

Personal assets and liabilities are also recorded differently on a personal balance sheet. Personal assets are recorded on the left side of the balance sheet, while personal liabilities are recorded on the right side of the balance sheet. The difference between the total personal assets and total personal liabilities is known as the individual’s net worth.

Examples of personal assets

Here are some examples of personal assets:

- Cash: Cash is a tangible asset that can be used to purchase goods and services.

- Savings: Savings are a current asset that represents the amount of money an individual has saved.

- Investments: Investments are non-current assets that represent the long-term investments made by an individual.

- Property: Property is a tangible asset that represents the real estate owned by an individual.

- Intellectual property: Intellectual property is an intangible asset that represents the exclusive rights to an invention.

Examples of personal liabilities

Here are some examples of personal liabilities:

- Credit card debt: Credit card debt is a current liability that represents the amount of money an individual owes on their credit card.

- Personal loans: Personal loans are current liabilities that represent the amount of money an individual has borrowed and must repay within one year.

- Mortgages: Mortgages are non-current liabilities that represent the amount of money an individual has borrowed to purchase a home.

- Student loans: Student loans are non-current liabilities that represent the amount of money an individual has borrowed to pay for their education.

- Car loans: Car loans are non-current liabilities that represent the amount of money an individual has borrowed to purchase a car.

In conclusion, personal assets and liabilities are two fundamental concepts in personal finance. Personal assets are resources that can be used to generate revenue, while personal liabilities are obligations that must be fulfilled. Understanding the difference between personal assets and liabilities is essential for managing personal finances. By keeping track of personal assets and liabilities, individuals can make informed financial decisions and achieve their financial goals.